The Management of Translation Exposure Is Best Described as

Selecting a mechanical means for handling the consolidation process for MNCs that makes this quarters accounting numbers as attractive as possible. The management of translation exposure is best described as A.

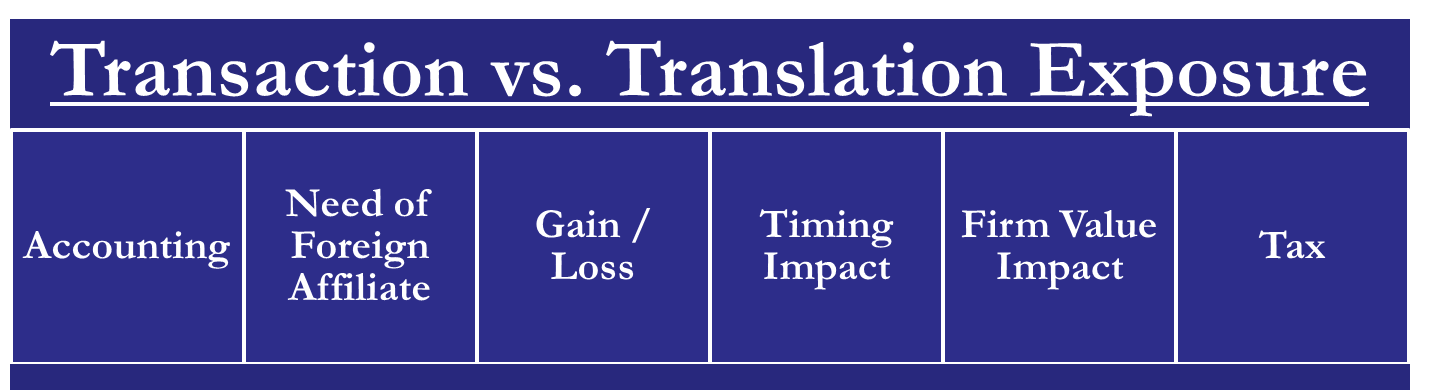

Transaction Vs Translation Exposure Efinancemanagement

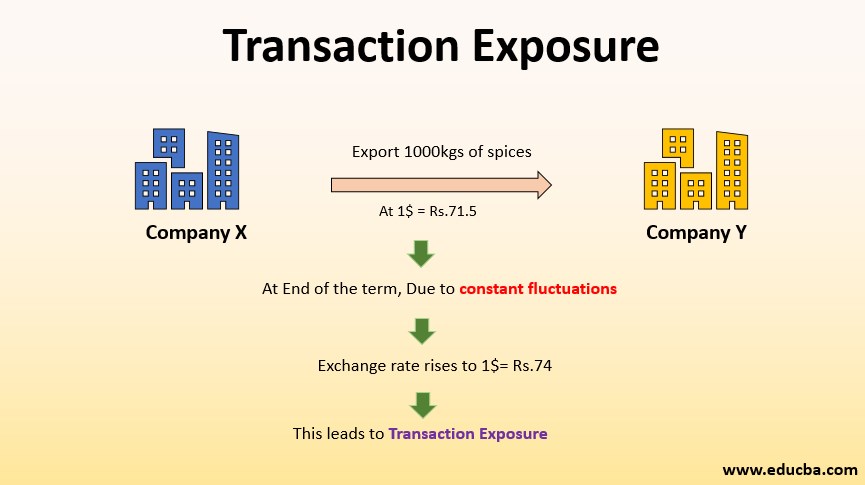

Changes in the value of outstanding financial obligations incurred prior to a change in exchange rates.

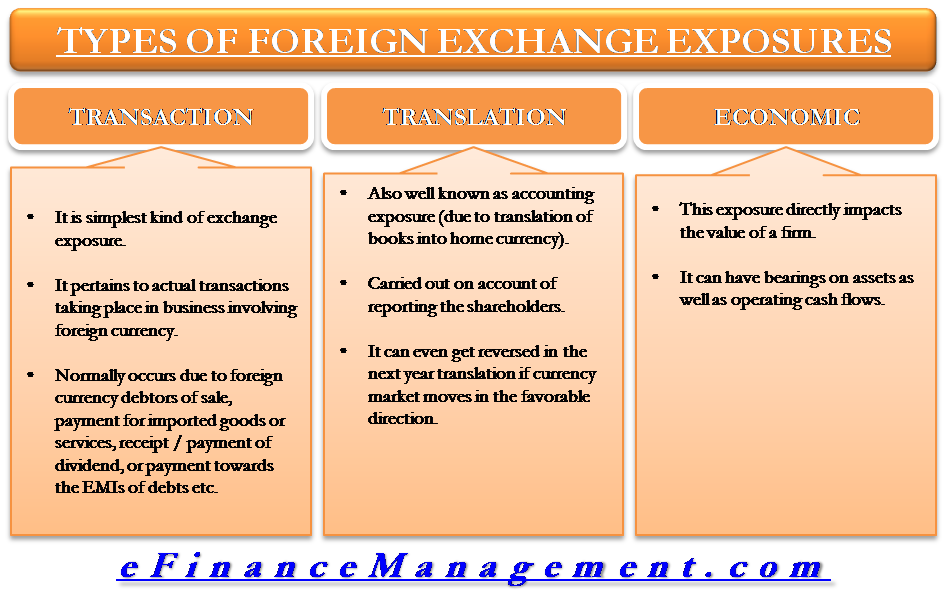

. This process of foreign currency translation results in accounting FX gains and losses. Translation exposure also known as translation risk is the risk that a companys equities assets liabilities or income will change in value as a result of exchange rate changes. Derivatives can be used by an exporter for managing.

The basic hedging strategy for reducing translation exposure shown in Exhibit 105 uses these methods. Provide specific examples to support your responseGenerally it is not possible to completely eliminate both translation exposure and transaction. Chapter Outline Translation Methods FASB Statement 8 FASB Statement 52 Management of Translation Exposure Empirical Analysis of the Change from FASB 8 to FASB 52 Translation Methods CurrentNoncurrent Method MonetaryNonmonetary Method Temporal Method Current Rate Method CurrentNoncurrent Method The underlying principal is that assets and liabilities.

These losses can occur when a firm has assets liabilities equity or revenue denominated in a foreign currency and needs to translate them back into its home currency. 1 adjusting fund flows 2 entering into forward contracts and 3 exposure netting. A firm operating in India cannot hedge its foreign currency exposure through.

Translation exposure is the risk of having changes in foreign exchange rates trigger losses on business transactions or balance sheet holdings. This is not established method of translation. Chapter Outline Translation Methods Management of Translation Exposure 1 Translation Exposure Translation exposure also called accounting exposure results from the need to restate foreign subsidiaries financial statements usually stated in foreign currency into the parents reporting currency when preparing the consolidated financial statements.

What is Translation Exposure. Firms have three available methods for managing their translation exposure. The translation exposure is positive when.

Under the monetarynonmonetary methodrevenue and expense items associated with nonmonetary accountssuch as cost of goods sold and depreciationare translat. In other words the translation exposure stems from the requirement of converting the subsidiarys. The effect that an unanticipated change in exchange rates will have on the consolidated financial reports of an MNC.

Translation exposure is a type of foreign exchange currency risk of change in the value of a companys assets equities income or liabilities due to fluctuations in exchange rates. The change in the value of a foreign subsidiaries assets and liabilities denominated in a foreign currency as a result of exchange rate change fluctuations when viewed from the perspective of the parent firm. Converting the values of a foreign subsidiarys holdings into the parent companys domestic currency can lead to inconsistencies if exchange rates change continuously.

105 Managing Translation Exposure. The potential for an increase or decrease in the parent companys net worth and reported net income caused by a change in exchange rates since the last consolidation of international operations. Selecting a mechanical means for handling the consolidation process for MNCs that logically deals with exchange rate changes.

Firms that denominate a portion of their assets liabilities and equities in a foreign currency face this risk. Translation exposure refers to A. The Translation Exposure or Accounting Exposure is the risk of loss suffered when stock revenue assets or liabilities denominated in foreign currency changes with the movement of the foreign exchange rates.

Meaning of Translation Exposure. 1 Translation exposure may also be called A transaction B operating C accounting D currency 2 Translation exposure measures A changes in the value of outstanding financial obligations incurred prior to a change in exchange rates. For contingency exposure of foreign exchange the best derivative that can be usedto hedge is.

Translation account exposure management refers to the methods used when a firm restates in the currency in which a company presents its financial statements of all assets liabilities revenues expenses gains and losses that are denominated in foreign currencies. Management of Translation Exposure Please respond to the followingFrom the e-Activity discuss the most significant ramifications of FASB 8 and FASB 52 on US. Translation exposure refers to.

Signin with Facebook Signin with Google. This occurs when a firm denominates a portion of its equities assets liabilities or income in a foreign currency. Get ready for the biggest online educational platform.

Translation exposure is the risk that a companys equities assets liabilities or income will change in value as a result of exchange rate changes. Translation exposure -also called accounting exposure refers to the effect that an unanticipated change in exchange rates will have on the consolidated financial reports of a MNC when exchange rates change. Translation exposure is a kind of accounting risk that arises due to fluctuations in currency exchange rates.

It is also known as Accounting exposure. Business and accounting firms. Translation Exposure is defined as the risk of fluctuation in the exchange rate that may cause changes in the value of the companys assets liabilities income equities and is usually found in multinational companies as their operations and assets are based in foreign currencies.

The effect that an unanticipated change in exchange rates will have on the consolidated financial report. View the full answer.

Translation Risk Definition Examples How Translation Risk Affect Firm

Transaction Exposure Complete Guide On Transaction Exposure

Types Of Foreign Exchange Exposure Transaction Translation Exposure

Comments

Post a Comment